The Future Is Vintage: How Younger Buyers Are Shaping the Watch World

Since the early 2000s vintage watch collecting has shifted from a specialist hobby to a global cultural and investment phenomenon.

Throughout this period, the secondary market grew from niche trading to major economic scale, with vintage pieces regularly outperforming modern equivalents in long‐term value growth.

Between 2020 and 2025, even factoring in the subsequent post-2022 market downturn, average resale prices for sought-after vintage models have risen more than 50%, Here are some examples, the prices are taken from Chrono24 and are based on a median value, in the period 2009 to the present, in euros:

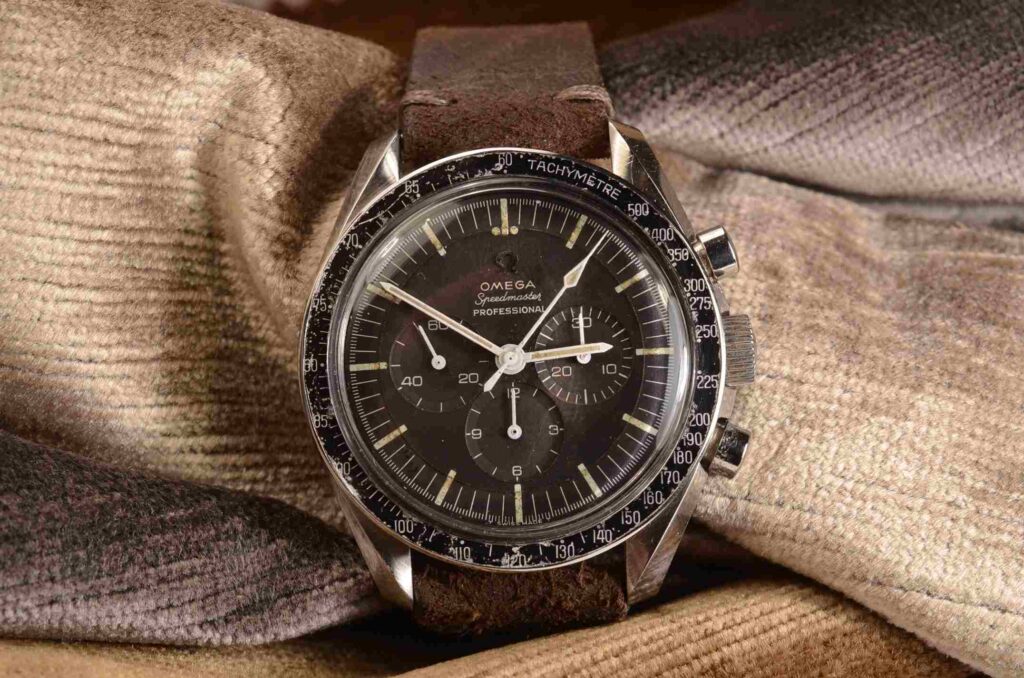

Omega Speedmaster Moonwatch: 2.500 – 5000 + 100%

Patek Philippe Nautilus 3711/01 – 25.900 – 170.000 + 559%

Patek Philippe Nautilus 5711/01 – 17.700 – 88.000 + 397%

Audemars Piguet Royal Oak 5402ST (2016) – 18320 – 76500 + 318%

Tudor Big Block 79180 – 3880 – 7017 + 80.8%

Current values remain elevated despite a correction of 20–30% since 2022.

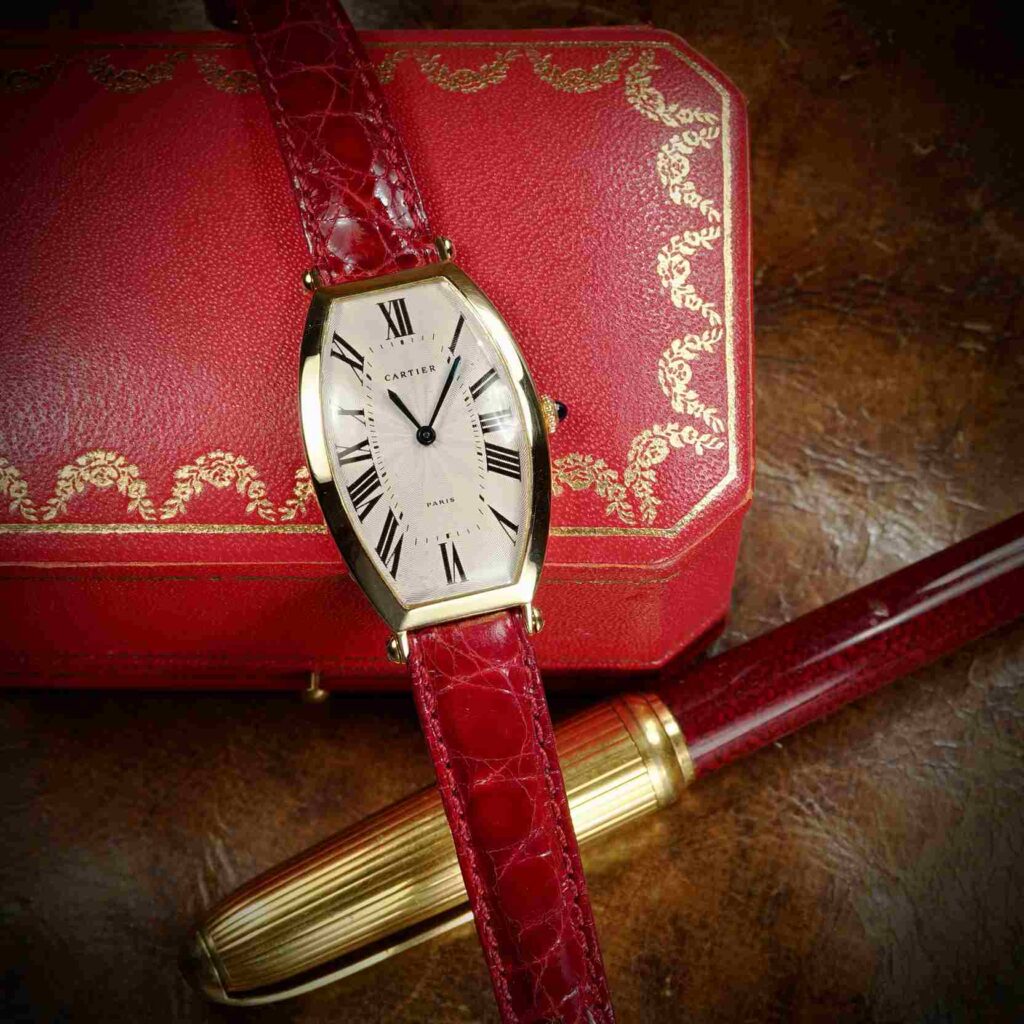

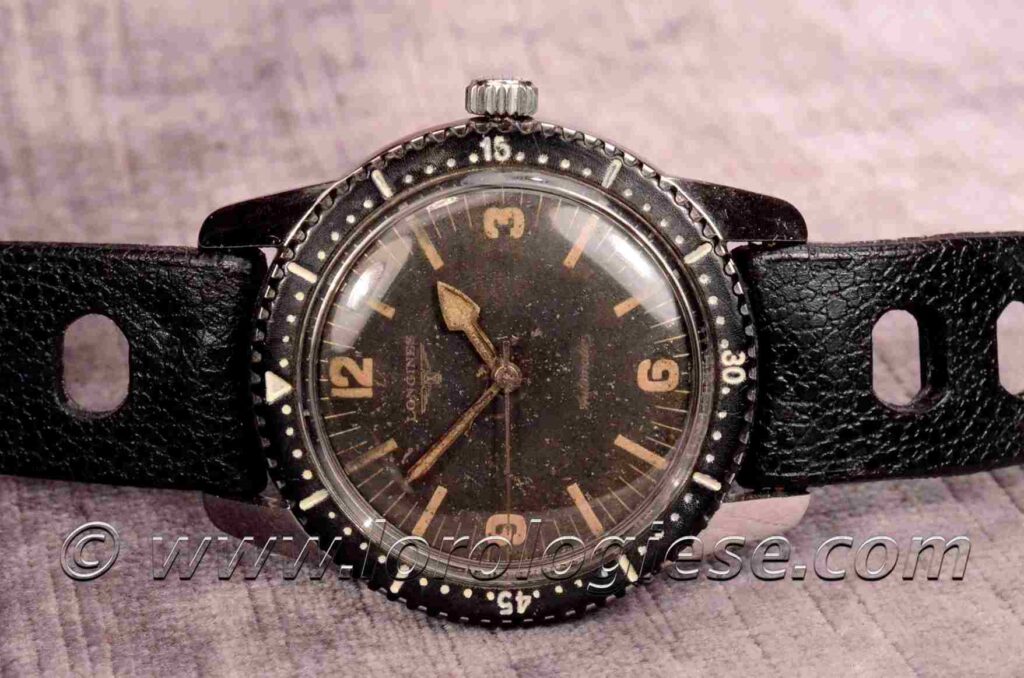

Yet, Not all watches are collectibe A collectible watch typically combines several key characteristics that elevate it beyond mere utility or vintage appeal.

Rarity is a foundational factor—limited production are often more sought after.Iconic status, such as association with milestone models like the Omega Speedmaster or Rolex Submariner, adds cultural and historical weight. Documentability: being able to verify a watch’s originality through serial numbers, archives, or period literature enhances trust and value. Historical significance—such as military issuance, technological innovation, or links to notable figures or events—adds narrative depth.

Manufacture quality, especially with in-house calibers and fine finishing, is highly regarded, particularly among brands known for technical excellence.

Condition and originality are equally crucial; untouched watches are more desirable than heavily restored examples. Watches that align with collecting trends—like tropical dials, copper tones, or step-case chronographs—may gain short-term attention, but timeless design typically prevails.

Lastly, a strong brand ecosystem—complete with archival support, auction presence, and active communities—fosters long-term interest. A watch that tells a broader story, whether in aviation, motorsports, or exploration, often resonates most deeply with collectors, making the blend of narrative, craftsmanship, provenance, and design the ultimate formula for collectability.

Growth in Collectors

Digital platforms have significantly fueled awareness and growth. Hodinkee (founded 2008), other blogs, reference sites have educated millions, and Chrono24 among others ahs created a quite reliable marketplace while forums and Instagram groups provide a constant stream of knowledge and shared passion. The National Association of Watch & Clock Collectors (NAWCC) now hosts over 10,000 active members and draws more than one million online visitors annually.

Social media, YouTube review channels, specialist podcasts, and charismatic influencers have amplified interest, turning watch collecting into an aspirational hobby and social phenomenon.

Young Buyers & Gen Z

Entry A recent Financial Times study shows 65% of Millennials and 61% of Gen X are interested in buying luxury watches under $5,000, and Gen Z is projected to represent about 20% of luxury watch buyers in the year ahead.

Younger collectors are drawn to pre‐owned and vintage watches for their authenticity, sustainability, and individuality.

Social media platforms—particularly TikTok and Instagram—are key in shaping trends and tastes in this demographic.

Global Market Expansion According to Boston Consulting Group, pre‐owned luxury watches accounted for nearly one‐third of total luxury watch market volume, with sales hitting roughly US $24 billion in 2021 and €22 billion in 2022 out of a $79 billion total market.

BCG also projects the pre‐owned segment to grow to $59.9 billion by 2033 at a CAGR of ~9.3%. Meanwhile, the global watch market is expected to exceed $100 billion by 2026, according to BCG.

The pandemic era saw demand soar, particularly for hard‐to‐find steel models, while the resale premium on Rolex, Patek Philippe, and AP watches grew nearly 50% between 2020 and early 2022, later cooling by up to 30% in 2023

A Business Insider study by Swiss finance researchers also found luxury watches demonstrate lower annual volatility (~3.9%) than real estate and bonds, while offering moderate returns comparable to equities—highlighting collectors’ shift toward watches as a tangible alternative asset The rapid expansion of digital platforms, online forums, Instagram, and watch groups—as documented by Financial Times—strongly implies exponential growth in collector numbers.

The FT has reported that Gen Z will soon account for 20% of luxury watch buyers, and that millennial demand surged by 20% in China alone in 2021. Such demographic shifts suggest not only rising interest but also a larger base of collectors.

Buying a vintage watch—when approached with careful curation and informed selection—can offer not only lasting horological satisfaction but also meaningful investment potential. Over the past two decades, key vintage timepieces have shown strong appreciation in value, particularly those meeting essential criteria: rarity, provenance, aesthetic balance, technical quality, and cultural significance.

While not all watches will increase in value, pieces from established maisons such as Rolex, Patek Philippe, Omega, and Universal Genève—especially those with excellent condition—have consistently performed well in the secondary market.

Yet beyond market trends, watches remain personal objects of beauty and craftsmanship— meant not only to be collected, but worn, cherished, and cared for. A significant part of the

reward in owning a vintage watch lies in its everyday use: the tactile pleasure of winding a mechanical movement, the quiet rhythm of its ticking, the way it ages alongside its owner.

This emotional and experiential dimension, often overlooked in purely financial assessments, is what turns a watch into a companion rather than just a commodity.